The Power of AP Automation: Transforming B2B Payments

Written by Pamela Rauseo, Principal Advisor @ Ocean Bridge Solutions | Fostering Innovation & Empowering People and Organizations through Digital Transformation & Curated Partnerships with a Focus on Strategic Change Management

February 11, 2025

The world of business-to-business (B2B) payments is undergoing a significant transformation. With companies moving away from paper checks and embracing digital payment solutions like Automated Clearing House (ACH) transfers, commercial cards, and other electronic methods, the shift is reshaping the landscape. Recent data highlights this change: global commercial credit card spending is projected to reach $3.57 trillion in 2024 and $5.07 trillion by 2028, according to Datos Insights.

This shift reflects not only the growing adoption of advanced payment technologies but also the powerful economic benefits they provide to both buyers and suppliers.

Breaking Myths About Commercial Cards

For years, many businesses resisted accepting commercial cards for B2B payments due to concerns about fees. However, new research by Forrester Consulting reveals that these worries may be outdated. In fact, commercial card acceptance delivers a net positive economic impact, significantly benefiting suppliers.

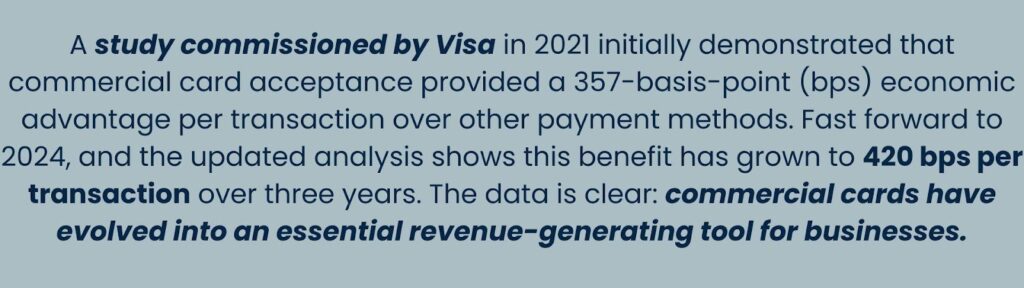

Study conducted by Visa provides strong business case for card acceptance.

The Bottom-Line Impact

Suppliers who embrace commercial cards are not only streamlining their payment processes but also experiencing measurable financial gains. Here are some compelling findings from the Forrester study:

- Revenue Growth: A composite organization with $10 billion in annual revenue achieved a 24% revenue increase over three years. This growth stemmed from retaining customers, attracting new ones, and driving larger, more frequent purchases.

- Improved Cash Flow: By significantly reducing Days Sales Outstanding (DSO) from 45 to 15 days, businesses improved their cash conversion cycles and working capital management.

- Enhanced Debt Collection: Card acceptance helped suppliers collect overdue payments more effectively, with surveyed businesses reporting a 20% improvement in debt collection rates.

- Process Efficiencies: Suppliers benefited from faster, more cost-effective account setups, streamlined payment reconciliation processes, and reduced administrative burdens associated with fraud prevention.

Why AP Automation Matters

Automated payment solutions, including commercial cards, offer businesses unmatched advantages:

- Streamlined Operations: Automation reduces the time and cost associated with manual processes like account setup and payment reconciliation.

- Increased Security: Stronger fraud prevention measures protect businesses and minimize legal and administrative burdens.

- Working Capital Optimization: Faster payments and improved cash flow free up resources for growth and innovation.

A Strategic Advantage for Your Business

The evidence is clear: adopting commercial cards and automated payment solutions is a smart move for businesses looking to enhance efficiency, drive revenue, and improve financial stability. While some companies have historically hesitated due to fees, the long-term benefits far outweigh the costs. In today’s fast-paced and competitive business environment, re-evaluating your payment acceptance strategy can unlock new opportunities for growth and success.

Ready to Transform Your Payments Process?

Explore how AP automation can help your business achieve measurable results. Let’s take the next step together. Schedule time to discuss the options and what to consider when ensuring the right fit for your business objectives. Click here to schedule time:

Click here for a consultation.

Or email Pamela Rauseo @ Pam@oceanbridgesolutions.com